An April 5 video covered a rare momentum shift in the S&P 500 that went into the history books on March 29 (see point A below). The study was updated in this week’s video, which can be found below in this post. The second leg of the study was conducted after the 12th consecutive weekly close above the S&P 500’s weekly MACD centerline (see point B below).

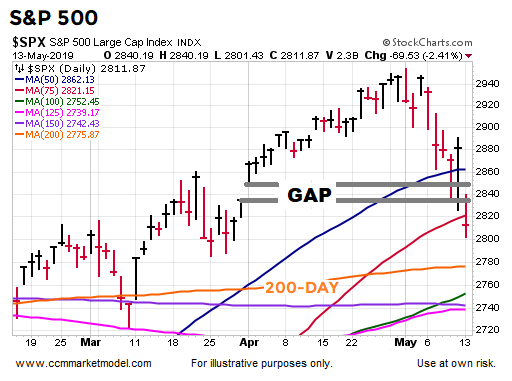

Given the market has pulled back since April 5, does the magnitude of the pullback between point A and point B raise concerns relative to market pullbacks that took place over a similar seven-week period in the sixteen historical cases? The answer is no. The table below shows the median drawdown that took place between similar points in the historical cases was 3.35%; the maximum drawdown was 7.06%, with 81% of the sixteen cases seeing a drawdown of less than 5%. The S&P 500’s 2019 drawdown comes in at a similar level of 4.55%.

Thus, to date, the market has not done anything to seriously jeopardize the original finding of keeping an open mind about better than expected outcomes in the stock market over the next 2-3 years. More details about the studies and the market’s subsequent historical performance can be found in the video below. Our schedule required this week's video to be recorded offsite.... if audio seems a bit off, should be back to normal next week.

SPEAKS TO ODDS

Each year is unique and 2019 will follow its own path. The 2019 setup and the market’s performance in the sixteen historical cases help us assess the probability of good things happening over the next few years relative to the probability of bad things happening. The U.S./China trade situation remains fluid, reminding us to maintain a flexible, unbiased, and open mind about shifts in the headlines and data.