SUNDAY TWEETS

A little after noon Eastern time on Sunday, President Trump shifted the odds related to this week’s scheduled trade talks between the United States and China.

LONGER-TERM OUTLOOK REMAINS FAVORABLE

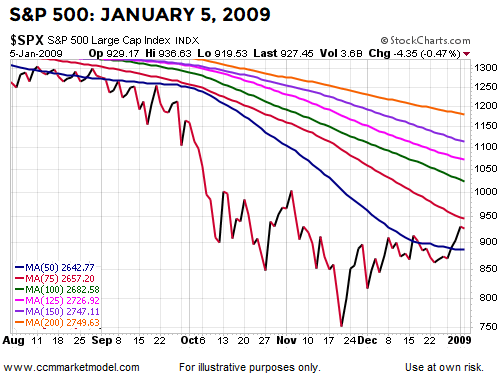

Given the look of the chart below during Monday’s session, it is fair to say the market’s longer-term trend remains favorable, something that is reflected in our current mix of stocks, bonds, and cash.

SHORT-TERM EVIDENCE OF WANING MOMENTUM

The market has moved a long way since making a V-bottom late in 2018 and is starting to show some signs of slowing momentum on shorter-term timeframes.

Under our approach, the million dollar question is:

Are we allocated properly based on the evidence in hand?

After making one minor chess move to lock in some gains in SCHB during Monday’s session, the answer is yes. Our exposure to cash and bonds takes into account the increasing odds of a 4%-10% pullback. Our exposure to stocks takes into account the term “odds” in the previous sentence and reflects the still favorable long-term outlook.

It is possible the waning momentum above will be followed by a pullback. It is also possible the market is simply pausing to digest the previous gains before pushing higher. In any event, the market’s intermediate-term risk-reward profile is not as favorable as it was a few weeks ago.

FIRST SET OF GUIDEPOSTS

Given present day facts, we will most likely be able to sit tight should the market decide to revisit the gap and or 50-day moving average shown in the chart below. Hypothetically, a move back toward the gap could represent an opportunity to redeploy some of our cash. As always, we will see how things unfold on the data front over the coming days and weeks. We are simply outlining one of many possible outcomes. As long as the USA/China trade meetings remain on the docket, it is easier to sit tight and respect the still-favorable long-term outlook. A cancellation of the trade talks could bring stronger selling pressure and lead to a decline of greater duration and magnitude.

SCHB has been lagging SCHX in recent months, which made it easier to lock down some of the gains in SCHB. Our last buy in SCHB came back on 2/22/2019.

On a positive note, the S&P 500 is still making a series of higher highs and higher lows. Protecting gains while trying to stay with the existing trend is a balancing act based on hard data and probabilities.

If selling conviction picks up later this week, another area of possible support lies between 2722 and 2815. A drop back to 2722 would represent a 7.5% correction from the recent closing peak of 2945. As we all know, a 7.5% pullback falls into the “normal and to be expected from time to time” category.

CONFIDENCE vs. CONCERN

The most relevant question is not “what was your last trade, a buy or a sell?”, but rather “how are we currently allocated between stocks, bonds, and cash?”. It may be helpful for clients to review their household allocations in these terms, which reflects all the data we have in hand (model/trends/bird strike):

% Allocation to Stocks = % Confident

% Allocation to Cash + % Allocation to Bonds = % Concerned

Given what we know today, it is prudent to be confident, but some concern is also warranted in the short-to-intermediate term. If the facts evolve in a manner that justifies some additional adjustments in the coming days/weeks, we will not hesitate to act.

WEEKLY VIDEO

This week’s video covers four long-term “be open to better than expected outcomes” setups in the financial markets.

This post is written for clients of Ciovacco Capital Management and describes our approach in generic terms. It is provided to assist clients with basic concepts, rather than specific strategies or levels. The same terms of use disclaimers used in our weekly videos apply to all Short Takes posts and tweets on the CCM Twitter Feed, including the text and images above.