demographics: a triple economic boom is coming

Three Primary Drivers In Years Ahead

In the next 10-15 years, the financial markets and economy will be significantly impacted by three major forces: (1) Millennials, (2) Generation Z, and (3) artificial intelligence. These forces could propel the secular bull market in stocks into the mid-2030s.

Distracted By The Baby Boomers

While it is true Baby Boomers are aging (59-77), we should not lose sight of the extremely large, well-educated, and economically influential younger generations, Millennials and Generation Z (Gen Z). Millennials overtook the Baby Boomers in 2019 to become the largest generation in the United States, which means focusing solely on Baby Boomers does not provide much insight into positive generational offsets.

Demographics provide insight into what is coming in the next 10-15 years, which is more important in the realm of investing than what happened in the last 10-15 years. Thus, markets are not focused on the current financial state of Millennials and Generation Z, but rather the inevitable progress they will make in the areas of income, home ownership, and wealth accumulation between now and 2035. As we march forward in time, the economic relevance of Millennials and Generation Z will increase every year and the economic relevance of the Baby Boomers will decrease.

Why Demographics Matter

Having a large percentage of the population available to perform productive tasks is a key driver of economic growth, something that became painfully obvious during the COVID pandemic. As shown in the graph below, the prime working age population (25-54) declined between December 2007 and December 2012, a challenging period for the U.S. economy and stock market. When the prime working age population began to rise again in 2013, the S&P 500 was able to exceed the highs made in March 2000 and October 2007. After peaking in 2018, the prime working age population bottomed out near levels seen at the 2007 peak and began to rise again in late 2021. Thus, the trend in this key labor metric is favorable in 2023, which partly explains the resiliency of the U.S. economy. The graph below shows the population of the 25-54 age demographic.

Key Workers Are Available and Willing to Work

Having a favorable trend in population does not necessarily equate to a population that wants to work. In the graph below, notice the 2020 COVID plunge in the age 25-54 labor participation rate, which was bad news for the U.S. economy. The good news is the key labor metric quickly resumed the favorable trend that began in 2015. In Q1 2023, the participation rate cleared the pre-COVID high, which means the labor market has improved significantly. The 25-54 labor force participation rate is above levels seen during the strong pre-COVID economic window.

Experience and Skills Add Value

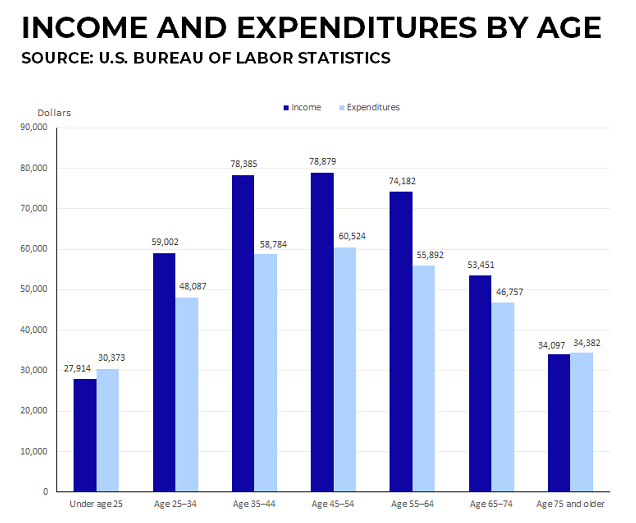

The second key metric that impacts economic growth is the quantity of workers with productive skills and experience, which is strongly correlated with earnings. Workers between the ages of 35 and 54 tend to be experienced and have a productive skill set that is in high demand. Thus, maximum career earnings logically fall in the age 35-54 window. Workers tend to spend and invest more when they are making good money.

A nation’s economy tends to thrive when the population between 25 and 54 is significant and that demographic is willing to work. A second economic boost comes when the economy has a large number of experienced and skilled workers between the ages of 35 and 54.

Demographics Are Favorable

Millennials (a.k.a. Gen Y) are the largest generation in the United States. In 2023, Millennials are between 27 and 42 years old, which means the entire generation is in the prime working years window (25 to 54). A second boost comes from Millennials that are in their peak earning, spending, and investing years (35 to 54).

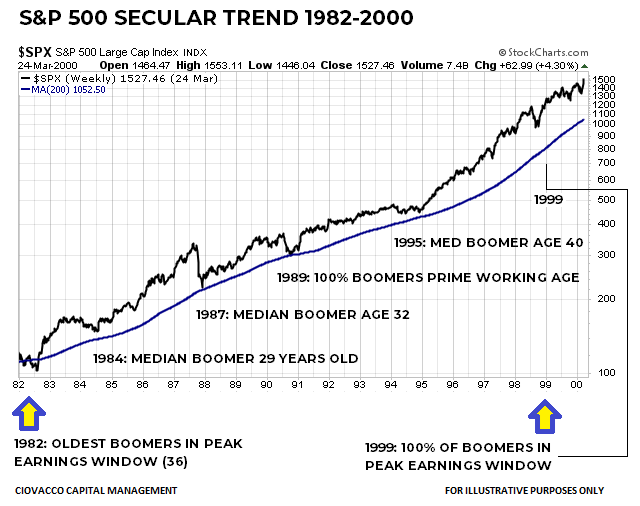

Between 2031 and 2035, 100% of Millennials will be in the peak earnings, spending, and investing window, which is similar to the very favorable 1995-2000 economic window when the median age of the Baby Boomers was 42.5 years old. Today’s largest generation, the Millennials, will be in a similar “demographic sweet spot” (median age of 42.5) between 2028 and 2034, telling us to remain open to better-than-expected economic and market outcomes between now and the end of 2034.

2023 Reference Point

The demographic comparison above speaks to the 1995-2000 and 2028-2034 windows. Since 2028 is still five years down the road, it is helpful to examine the period preceding 1995-2000. The median age of the largest generation in the United States between 1988 and 1994 was 36. The chart below shows S&P 500 performance between 1988 and 1994 (see blue box). Today’s largest generation, the Millennials, will be in a similar “demographic sweet spot” (median age of 36) between 2022 and 2027, telling us to remain open to better-than-expected economic and market outcomes between now and the end of 2027.

A One-Two Demographic Punch

Some demographers break Baby Boomers into two subgroups; Boomers One (1946-1954) and Boomers Two (1955-1964). Boomers Two are also known as Generation Jones. Boomers One and Generation Jones created a double boom in the 1989-2000 window, when 100% of the massive Baby Boomer generation were in their prime working years between the ages of 25 and 54. As shown below, the stock market performed quite well in the double boom window.

Double Boom Two

A similar double boom is coming in the United States. Right behind the Millennials (1981-1996) is the also very large Generation Z, born between 1997 and 2012. In 2023, the entire Millennial generation is in the prime working age window (25-54) and that will be true until 2035, creating an economic and stock market tailwind that will be in place for the next 12 years. It gets even better; Gen Z is projected to overtake the massive Millennials in 2034. Thus, two exceptionally large generations in the United States are on the younger end of the spectrum. The oldest members of Gen Z are 26 years old in 2023, which means another very large generation is just entering the prime working years window (25-54).

Experienced and Tech Savvy

Millennials were born between 1981 and 1996, which means they were between 7 and 22 years old when the internet had already exploded to over 600 million users in 2003. Millennials are comfortable with technology and the concept of self-education to acquire new knowledge and skills. Generation Z was born between 1997 and 2012, which means millions of them were not born yet when the iPhone was introduced in 2007. Members of Generation Z grew up in a world with internet access and smart phones, making them arguably the most tech savvy generation in U.S. history to enter the workforce.

“Work by the firm’s economic team, along with an in-depth survey of Generation Y and Z consumers, uncovered a significantly brighter outlook for the U.S. in the coming decades than previously thought. As Gens Y and Z combine in the workforce, these two outsized generations could power higher consumption, wages and housing demand, all pillars of GDP growth.”

Having a lot of workers in the prime working age window is good for the economy. A second boost can come when large demographic groups are experienced and highly compensated. When Millennials are in their peak earning, spending, and investing window between 2031 and 2035, Gen Z will be between the ages of 19 and 38, which means experienced Millennials will be working with a highly skilled and educated workforce.

In 2023, the economic and investing future is bright with two very large segments of the population currently ranging between 11 and 42 years old. In five years, they will be between 16 and 47 years old. In 12 years, they will be between 23 and 54 years old, which means the labor market should remain quite favorable between 2023 and 2034 for economic growth and innovation.

Wealthy Boomers Are Still Stimulating

While it is true Boomers are aging (59-77), they are part of a hybrid retirement income generation, which has some positive elements. Congress approved Internal Revenue Code Section 401(k) in 1978 forever changing the retirement income landscape. According to Yardeni Research, Baby Boomers had a net worth of $74.8 trillion at the end of Q1-2023, with a significant portion of that wealth stored in tax-deferred 401(k)s and IRAs. Since the oldest Boomers are 77, a significant portion of the formerly largest generation are already subject to required minimum distributions (RMDs), which should encourage discretionary spending and gifting to younger generations.

Boomer Bull Market

The chart below was shown on July 10 in an article that provides visuals for secular bull markets and periods of secular stagnation.

The following chart shows the same period with demographic milestones.

MILLENNIAL AND GEN Z BULL MARKET

The charts below show the S&P 500’s change in character during a secular period of stagnation (2000-2012) and the early stages of a new secular trend (2013-2016). During the periods of secular stagnation, the market tends to oscillate above and below the 200-week moving average shown in blue. During secular bull markets, the market tends to make stands near an upward-sloping 200-week moving average as it did in 2016.

The S&P 500 made a stand in October 2022 at an upward-sloping 200-week moving average, which kept the secular trend door open. However, notice in the two S&P 500 charts above, the market bounced at the 200-week in 2008 but then reversed and accelerated to the downside. Thus, between October 2022 and early June 2023, the market was improving but had not cleared some important hurdles.

One of the key “this does not look like the failed bear market rallies in 2002 and 2008” hurdles was cleared on June 2, 2023. In the failed rally attempts in 2002 and 2008, S&P 500 weekly RSI could not clear 55 (chart below). On June 2, 2023, weekly RSI closed at 63, which increased bullish odds. How painful were the drawdowns in 2002 and 2008 after weekly RSI failed near 55? Very painful - the additional loss in 2002 was 33.51%; in 2008, the additional loss was 52.54%. Weekly RSI closed on July 21 well above 55 at 69, which does not align with “ongoing bear market” odds.

Demographics and Common Sense

Typically, factors that have broad and long-lasting economic and market impacts are easy to understand when you break them down into smaller pieces. If you want to understand the impact of demographics, evaluate your own spending and investing habits over time and those of people older than you and younger than you.

When you earn more, you tend to spend and invest more, which is good for the economy and corporate earnings. We know the age and population figures for Millennials and Gen Z. We know they are going to age, gain knowledge and experience, become more productive and make more money. It is the reason for the expression you can’t stop demographics.

When there is an abundance of workers between the age of 25 and 34 (less experienced) to collaborate with workers between the ages of 34 and 54 (more experienced), the economy can operate in a more productive manner, which is beneficial for all segments of the population and financial markets.

Could See A Triple Boost With AI

Future economic and market outcomes will be impacted by the double boost from Millennials and Generation Z. The significant strides that have been made with Artificial Intelligence (AI) applications in recent months tell us worker productivity could improve in numerous industries in the years ahead. The Baby Boomer bull market (1982-2000) was fueled in part by the introduction of the IBM PC in late 1981 and Lotus 1-2-3 (spreadsheets) in January 1983. In 1984, Apple introduced the Macintosh personal computer with a built-in screen and mouse.

“According to researchers at Goldman Sachs, widespread adoption of AI-powered tools could drive a 7% uplift to global GDP and raise productivity growth by 1.5 percentage points over a 10-year period, ”

Education Means Higher Future Earnings

There is a strong correlation between education and career earnings. The 2019 Pew Research Center chart below shows Millennials and Generation X are better educated than Baby Boomers. Markets are forward-looking mechanisms, and thus, from an investing perspective, the known gains that are coming in experience, earnings, home ownership, spending, and investing are highly relevant.

housing: supply and demand imbalance

According to Builder Magazine, housing’s share of GDP was 17.7% in the first quarter of 2021, which represented a near 14-year high. When housing is strong, it impacts the entire economy in a favorable manner. Morgan Stanley highlighted the favorable backdrop for housing in 2021:

The aging of millennials and Gen Z should also create opportunities in the housing market. Given this favorable demographic demand backdrop, along with tight housing supply following years of depressed building in the aftermath of the financial crisis, we believe residential real estate should perform well in the cycle ahead. We like exposure to US housing, and homebuilders, in particular.

As we have noted numerous times in weekly videos, the chart of the Homebuilders ETF (ITB) seems to align with the demographically-induced secular bull market thesis. Housing stocks, while highly volatile, made stands near an upward-sloping 200-week in 2018, 2020, and in October 2022, which is exactly what we would expect during a secular bull market.

How Is All of This Helpful?

The objectives of asset allocation are significantly different in periods of secular stagnation and secular bull markets. Thus, our goal is to manage against the base case, which is stocks are in a demographically-propelled secular bull market that could last until 2034. Under secular bull market conditions and in the context of higher interest rates/inflation, we will be willing to accept normal volatility as long as the weight of the evidence continues to align with the base case. If the weight of the evidence shifts to a secular stagnation profile, we will migrate to a more defensive portfolio allocation.

Realistic Expectations

“You can’t stop demographics.

”

The 1982-2000 secular bull market in stocks produced extremely satisfying returns. However, the 1982-2000 window included an economic recession (1990-91) and the 1987 stock market crash. Thus, a secular trend does not mean easy and with no volatility. Even if good things happen between now and 2034, we will have better odds of capturing satisfying returns if we embrace volatility as a normal part of even the strongest bullish trends.

FAQs - Getting Started with CCM

Subscribe to CCM’s YouTube Channel. Follow CCM on Twitter.

The Resumption of the Secular Bull Market

In the June 2023 weekly video below, data-based visuals are used to make the case the stock market’s secular trend resumed in October 2022.

Why Bonds and Balanced Portfolios May Disappoint

The video below covers a recent development in the financial markets that will impact portfolio returns for decades:

Demographics and Stock Market Returns

This video overlays demographic data on the chart of the S&P 500 Index dating back to 1964 to gain an understanding of risk and reward between 2023 and 2034.