RECESSION AND HIGH INFLATION?

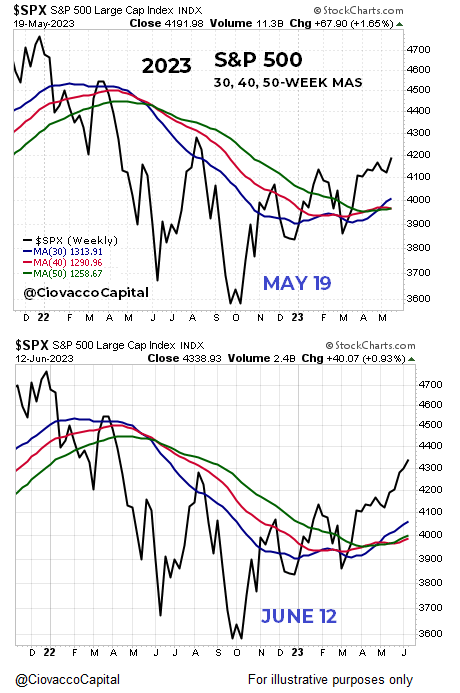

While there was quite a bit of fear as the debt ceiling x-date was fast approaching, a May 18 post noted the trend in the top chart below was more constructive relative to the 2011 debt ceiling window. The markets held up well during the political theatre with the S&P 500 pushing to new multi-month highs (bottom chart).

With CPI, PPI and the Fed remaining on this week’s docket, the market will be getting numerous key data points to digest. A May 22 post compared the S&P 500’s weekly trend to major bear markets allowing us to draw the following conclusions:

Charts cannot predict the future, but they can help us assess the odds of good things happening relative to the odds of bad things happening. The trends reflect the market’s interpretation of all the relevant fundamental topics (economy, earnings, inflation, rates, Fed policy, liquidity risk, banking system risk, etc.). While there are numerous legitimate concerns in 2023 related to all those fundamental topics and ongoing debt ceiling negotiations, the charts shown above tell us to keep an open mind about better-than-expected outcomes relative to the painful outcomes in 2002, 2008, 2011, and 2016.

The second chart below shows the constructive weekly setup that remains in place as of June 12.

A May 30 post noted the Consumer Discretionary sector (XLY) was in a position to possibly contribute in a more positive manner, based on the May 26 setup below:

The XLY chart above demonstrates that nothing has happened to contradict the favorable thesis from last month. A June 1 post compared the look of the stock/bond ratio below in 2000 and 2007 to 2023 noting it was fair to say 2023 market participants are not nearly as concerned about a deep economic recession and a big hit to corporate earnings as they were in September 2000 and October 2007.

The June 12 version of the same S&P 500 to 10-Year Treasury Price ratio allows us to draw the same constructive conclusions.

A June 5 post noted market conditions are most favorable when trends are constructive on daily, weekly, and monthly timeframes, which is a reflection of the interpretation of the fundamentals. It is common for longer-term bear markets to fail to attract buying support near the 50-month moving average, as shown in the 2000-02 chart below:

An updated version of the same monthly S&P 500 chart continues to look more like a secular bull relative to a secular bear.

Last week we noted many important volume-based charts were showing a discernable shift. As long as the charts of the Vanguard Total World Stock ETF (VT) and Equal-Weight S&P 500 ETF (RSP) maintain the constructive looks below, we should be open to seeing the stock market rally broaden out in the coming weeks.

The Weight of the Evidence

This week’s CCM stock market video reviews numerous indexes, sectors, regions of the globe, and ratios to gain a better understanding of the market’s read on future economic and earnings outcomes.

MORAL OF THE STORY

Bullish trends occur when market participants interpret all the fundamental data in a manner that is favorable for future economic outcomes. The economic and technical data continue to tell us to remain open to better than expected outcomes in the months ahead.

Inflation remains well above the Fed’s target, which means while the Fed may pause in June, future rate hikes cannot be ruled out. If the Fed keeps hiking, the economic impact could lead to job losses, curtailed spending, lower corporate profits, and a recession. This bearish scenario is currently not supported by the market charts, nor the fundamentals, but must be respected as long as inflation remains elevated.