TESTING THE LOWER END OF THE RANGE

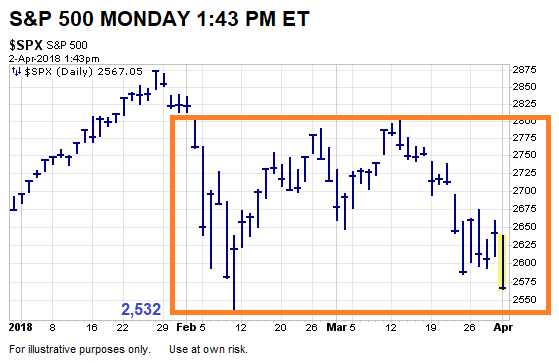

The S&P 500 is approaching the lower end of the recent range. A sustained move below 2,532 would provide additional support for the bearish case. Comments made on March 21st and in this week's video still apply.

BULL/BEAR INFLECTION POINT

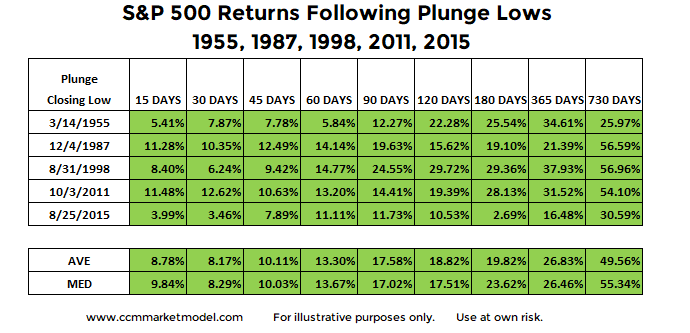

The lower end of the range represents a possible inflection point. As noted on February 6, reversals near a prior low can be sharp (see table below). At these levels, there is a fine line between prudent patience and prudent capital preservation.

GAME PLAN REMAINS THE SAME

As anticipated, with price near the lower end of the range, some additional deterioration has started to show up in the hard data tracked by the model. Like the market, the data is near an important juncture where further weakness will most likely require some allocation shifts before the end of the week. If the market can make a stand near current levels, we will most likely be able to sit tight. The market and the hard data will make the call.