The market opened down Tuesday. Since humans tend to focus on what is in front of them (a red screen), it is prudent to review some "stay focused on the facts" key points.

KEY #1: IT STILL LOOKS LIKE A BULL

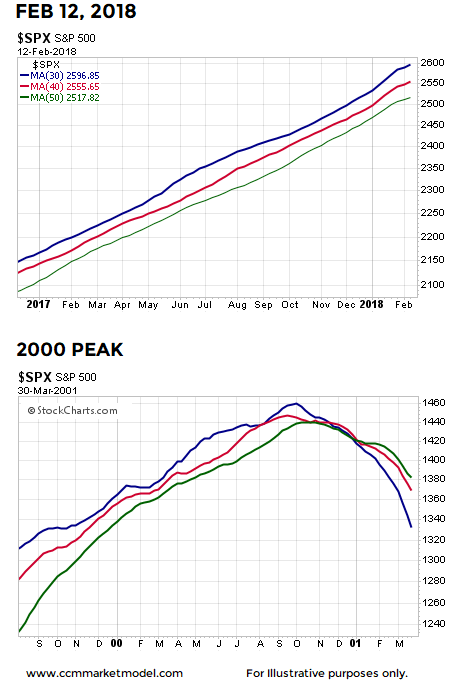

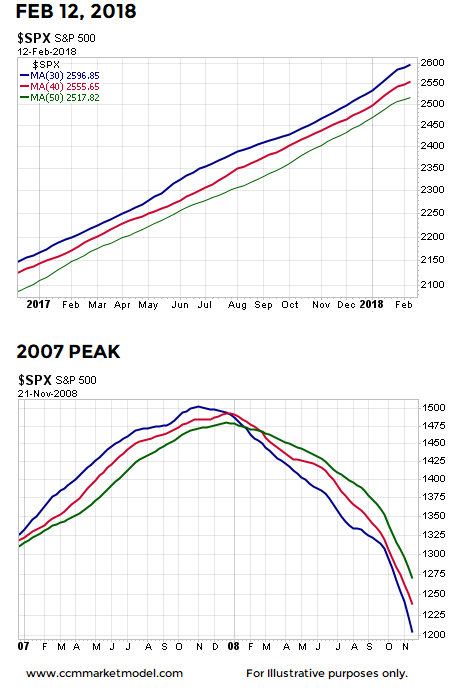

The video at the bottom of this post compares 2018 to 2000 and 2007 using numerous timeframes; the conclusions are the same.

KEY #2: 2018 HAS THE STRONGEST RELATIVE PROFILE

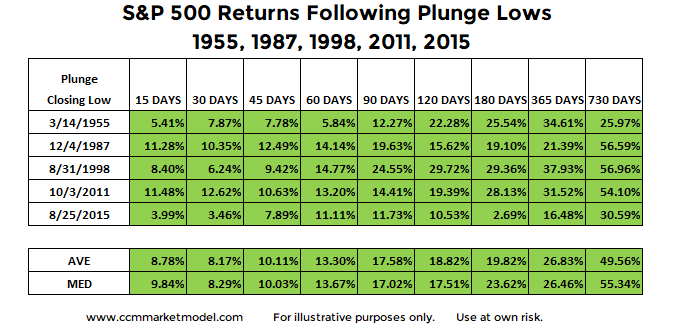

As outlined in detail in Stock Market Plunge Period Reference Points, 2018 has the strongest fact/data-based profile relative to the volatile periods shown below. When plunges occur from strong market profiles, the waterfall drop tends to be sharp, but relatively brief in duration.

KEY #3: BULL MARKETS MAKE HIGHER HIGHS

We are currently in a bull market. Bull markets by definition make a series of higher highs and higher lows. Thus, if we believe the bull market is still intact, at some point in the future, stocks will make a new all-time high. Bull markets reward those with patience and a long-term focus.

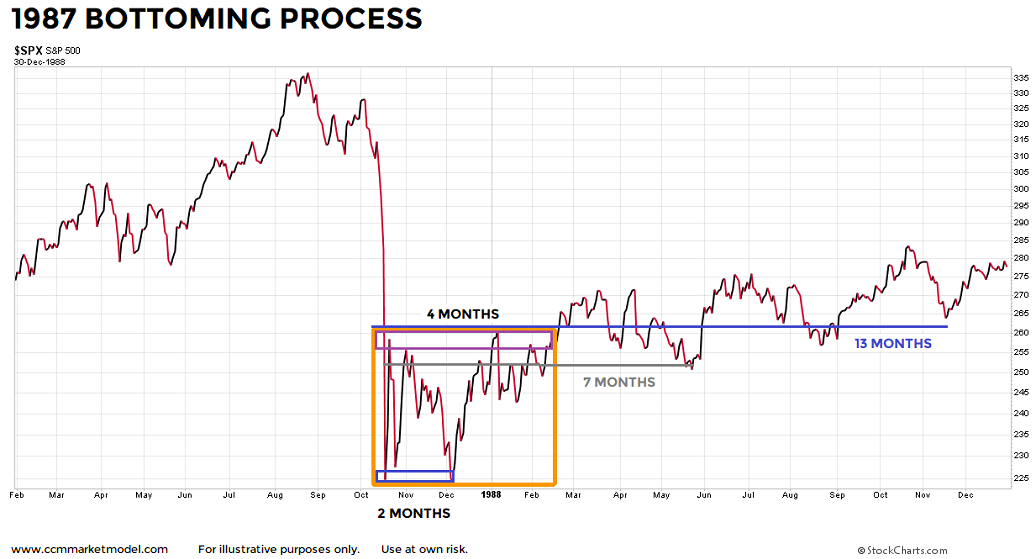

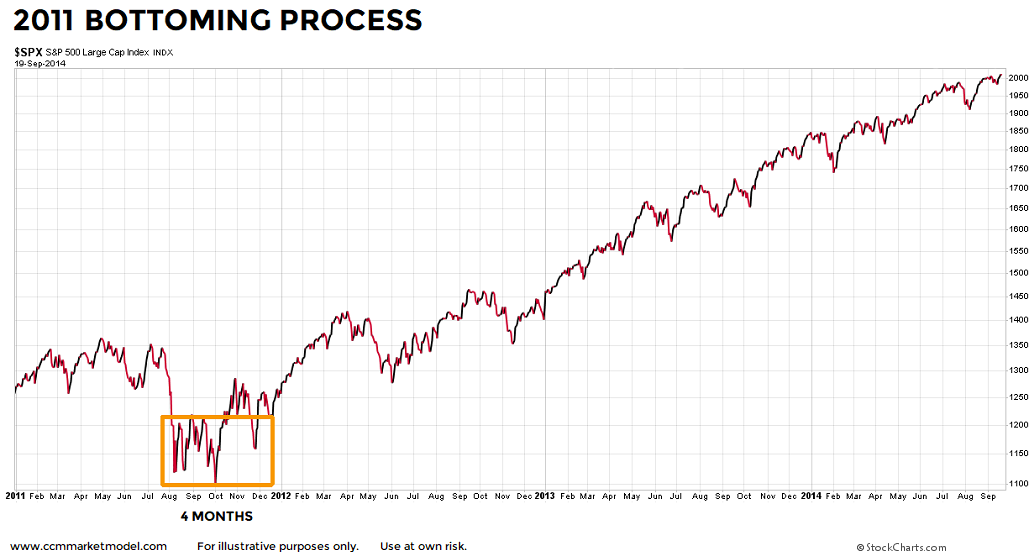

KEY #4: BOTTOMS CAN TAKE TIME TO FORM

As shown in the charts below, even after the plunge period was complete, it was not a volatility cake walk in the three historical cases. In 1987, the S&P 500 printed a slightly lower low two months after the waterfall plunge.

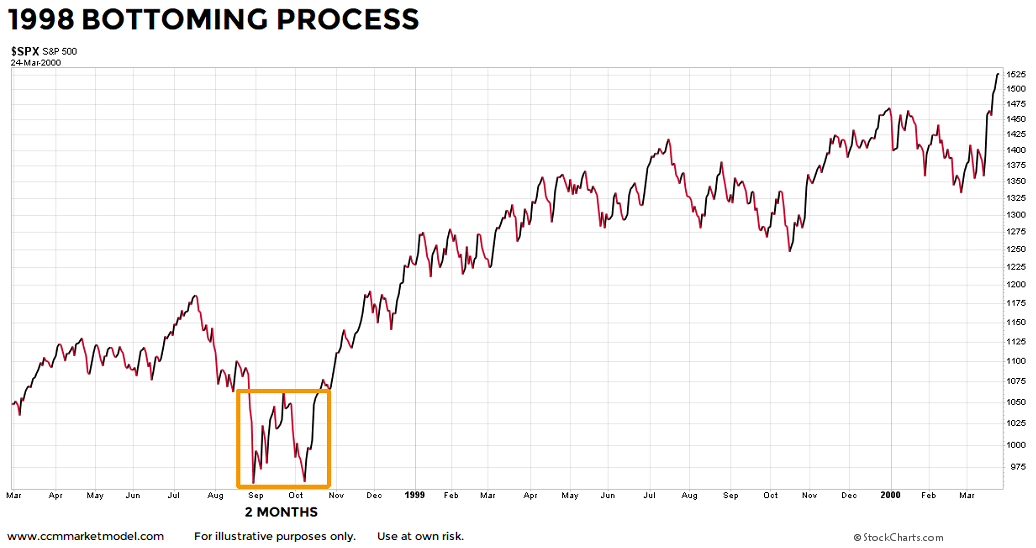

In 1998, the original plunge low was retested a few weeks later and price stayed inside a yo-yo box for two months. Nothing says the market has to give an "all clear" signal after a plunge.

In 2011, stocks were in a bull market, a waterfall decline occurred, and stocks subsequently stayed inside a wild-ride volatility box for 4 months. As expected in a bull market, stocks eventually followed the plunge with very satisfying gains.

IN EACH CASE, A HIGHER HIGH WAS MADE

2018 really doesn't look anything like 2000 or 2007. 2018 is stronger than 1955, 1987, 1998, 2011, and 2015 (bull market cases). In every bull market case, stocks eventually followed the bull market script and printed a higher high. A higher high means higher profits and higher account balances relative to pre-plunge profits and balances.

REALISTIC EXPECTATIONS ARE PART OF ANY SUCCESSFUL ENDEAVOR

It would be great if the stock market was green every day and we never had a correction in a bull market. Common sense tells us that is not realistic. Even if we remain in a bull market and stocks eventually go on to make a new all-time high later this year (TBD), we should not expect every day, every week, or every month to be green.

The market's present day long-term profile allows us to be patient. If the profile deteriorates in a material manner, then we will take the necessary defensive steps. We will continue to take it day by day, remaining open to all outcomes.