demographics & secular trends:

The CCM weekly video to be published on July 21, 2023 will provide an important update on demographic trends in the United States and the potential impact on the economy and stock market. The video will be available on Short Takes (a link will also be available on the CCM Twitter Feed after publication).

SPY’S STRENGTH MATTERS

The odds associated with all investments (ETFs, individual stocks, bonds, etc.) are impacted by the market's tolerance for risk, which can be monitored numerous ways, including via the S&P 500 Index and/or the SPDR S&P 500 ETF (SPY). As shown in the SPY chart below, the market's risk-reward profile has significantly improved over the last 6 to 8 weeks. The market has flipped from a downtrend back to an uptrend, as market participants have become more positive about future economic and earnings outcomes. This is good news for stocks and risk assets in general.

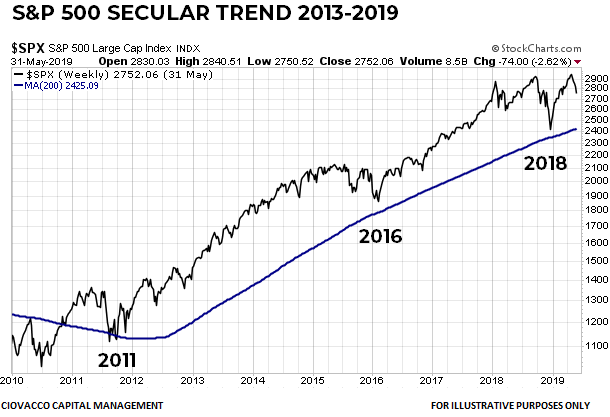

RESUMPTION OF SECULAR BULL MARKET

As outlined in detail earlier this month, the evidence in hand points to a resumption of the secular bull market in stocks. The chart below shows the S&P 500 making a stand near an upward-sloping 200-week moving average, a hallmark of a long-term and sustainable bullish trend in risk assets. If the longer-term trend is resuming, it must be supported by an increasing appetite for risk, something that is evident in the SPY chart above and in the charts covered in the remainder of this article.

A.I. WILL IMPROVE PRODUCTIVITY

In recent years, the economy has been dealing with a mismatch between the availability of skilled workers and strong demand for goods and services. This mismatch has driven wages and inflation higher. Technology tends to automate tasks, which can make existing workers more productive. Thus, A.I. should help drive down inflation and increase corporate earnings. All of this is reflected in the chart of the Global X Robotics and Artificial Intelligence ETF (BOTZ). BOTZ has broken out from a multi-month basing formation and now has a profile indicative of more favorable odds. Charts cannot predict the future; they assist with the assessment of bull/bear probabilities.

DEMOGRAPHICS AND DISCRETIONARY SPENDING

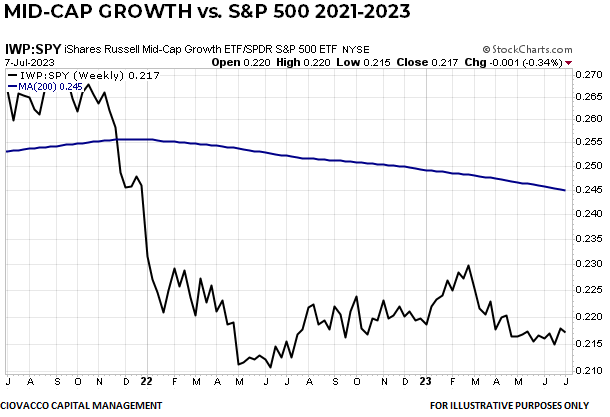

Long-term, or secular, stock market trends are heavily influenced by demographics. The United States has two demographic tailwinds that are driving discretionary spending. The largest demographic, the Millennials, are in the early stages of their peak earnings and spending years. Consumption demand of Millennials is being complimented by wealthy Baby Boomers, who have significant balances in 401(k)s. The trend in the Consumer Discretionary SPDR (XLY) vs. Consumer Staples SPDR (XLP) ratio has a significantly improved look in July 2023 relative to 2022, which speaks to increasing confidence about the economy and earnings.

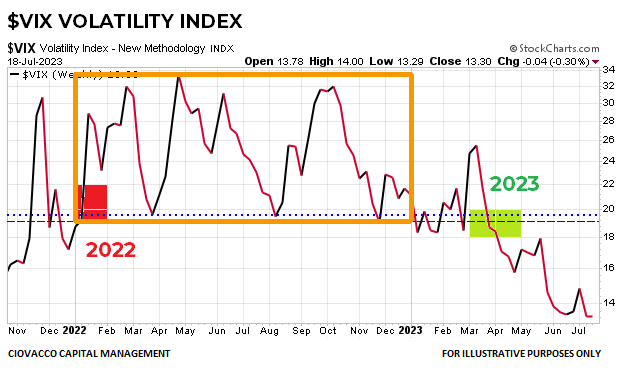

COMPLACENCY OR CONFIDENCE?

If we objectively review the chart of the VIX Volatility Index (VXZ) below, it is easy to see calendar year 2022 looks significantly different from 2023. This shift reflects expectations that future stock market volatility will be tamer relative to 2022.

It may seem logical to read a low VIX as a sign of investor complacency. A recent tweet from Mark Ungewitter says that may not be the case. Historically, a VIX below 14 has been indicative of strong bullish trends in the S&P 500.

INSTITUTIONS ARE IN NO RUSH TO SELL

Anchored Volume Weighted Average Price (AVWAP) can be used to monitor market participants' appetite for risk. The AVWAP profile for the NYSE Composite Index shows selling pressure at key points in 2022. In recent weeks, the multi-sector index found buying support near the AVWAP lines tied to the COVID high and COVID low. In July, price has pushed back above the thick AVWAP band that acted as resistance in Q1. The S&P 500 and NASDAQ successfully pushed away from similar AVWAP bands earlier in 2023. The current look of the chart below speaks to a rally that is broadening out in a constructive manner.

GOLD SHOWING RELATIVE WEAKNESS

The SPDR Gold Shares ETF (GLD) vs. SPY ratio below is stalling near an area associated with sustainable stock market lows in 2011 and 2020. After the 2011 low, the stock market rallied until 2015. The 2020 low was followed by gains that lasted for approximately 21 months.

HAVE YOU MISSED THE RALLY?

During the early stages of a new bullish trend, it is common for investors to believe all the opportunity has come and gone. The chart of the SPDR Dow Jones Industrial Average ETF (DIA) says that is most likely not the case. In 2022, DIA was making a series of lower lows and lower highs, a textbook downtrend. To flip from a downtrend to an uptrend, three major steps are necessary. First, the market needs to exceed the downward sloping trendline. Second, the market needs to print a higher low. Third, the market needs to print a higher high. DIA is trying to successfully complete the third step in July 2023, meaning an established uptrend could just be getting started.

CREDIT MARKETS SHOW INCREASING CONFIDENCE

Since the history of the SPDR High Yield Bond ETF (JNK) is limited, the chart below shows the Vanguard High Yield Corporate Bond Fund (VWEHX) dating back to 1998. Notice how high yield bonds found buying support near the 50-month moving average, shown in blue, near major stock market lows in 2002, 2009, 2016, 2020, and 2022. In the historical cases, the stock market rally had much further to run.

CONTRADICTS IMMINENT RECESSION THEORY

If widespread layoffs, a big hit to corporate earnings, a painful recession, and Fed rate cuts were just around the corner, would we rather own economically-sensitive stocks or more-recession-friendly Treasury bonds? The answer is simple - Treasury bonds, which would get a tailwind from Fed rate cuts, rather than stocks which would be susceptible to declining earnings per share. The SPDR S&P 500 ETF SPY vs. iShares 3-7 Year Treasury Bond ETF (IEI) ratio just broke out following an 18-month period of consolidation, showing market participants prefer growth-oriented SPY over defensive-oriented IEI.

STOCKS TYPICALLY DO WELL WHEN THIS HAPPENS

When the U.S. Dollar vs. S&P 500 ratio drops below and moves away from the 200-week moving average, shown in red, it speaks to an increasing appetite for risk. The S&P 500 is shown in the bottom panel.

ECONOMIC AND RATE CONCERNS

As concerns about inflation and higher interest rates started to increase in 2021, the First Trust Dow Jones Internet Index ETF (FDN) began to underperform SPY. As concerns about inflation and interest rates began to ease in the second half of 2022, the FDN vs. SPY ratio began to build a constructive multi-month base. Since early May 2023, the chart below has improved considerably, demonstrating an increased willingness to embrace growth-oriented assets.

SUBTLE BUT IMPORTANT

The left side of the Vanguard Total Stock Market (VTI) chart below has a constructive look with the blue 50-day moving average on the top of the moving average cluster and the silver 250-day on the bottom; this is what a strong uptrend looks like. For the first time in over a year, the right side of the chart has recaptured a similar and bullish look. In Q4 2022, the blue 50-day was still on the bottom of the moving average cluster; today, it sits on top, which means market participants are more optimistic on numerous timeframes.

NOT SCREAMING SYSTEMIC

There are problems with regional banks; problems that may be with us for several more years. However, the chart of the SPDR Financial Sector ETF (XLF) has held in an area that reduces the odds of a systemic banking crisis. Unlike 2007-2008, XLF has made a stand near the red 200-week moving average.

INFLATION, THE GREENBACK, AND RATES

All things being equal, the iShares Emerging Markets Bond ETF (EMB) would prefer an environment with lower inflation, lower interest rates, and a weaker U.S. Dollar. None of those conditions were present in 2022 and EMB suffered. The outlook has slowly improved since the second half of 2022. EMB is trying to break above a constructive multi-month base, which speaks to expectations about inflation, Fed policy, and the U.S. Dollar.

YIELD AND DEFAULT RISK

If we knew with 100% certainty the economy was going to avoid a recession and bond defaults would remain muted, would we rather own higher-yielding corporate bonds or lower-yielding Treasuries? The chart below shows investors do not seem overly concerned about a recession and widespread bond defaults.

CONFIDENT OR CONCERNED?

When investors became more confident near the February 2016 low in SPY, they shifted from a preference for the SPDR Consumer Staples ETF (XLP) to a preference for SPY. As a result the SPY vs. XLP ratio began to rise in early 2016. A similar and constructive reversal in the SPY vs. XLP ratio occurred near the major 2020 low in the stock market. The look of the chart below is very similar to the look following stock market lows in 2016 and 2020, which speaks to increasing confidence about the economy, earnings, and inflation.

WHAT DOES LONG-TERM MEAN?

Charts cannot predict the future. They help us assess the market's willingness to embrace or shun risk, which in turn helps us assess the probability of good things happening relative to the probability of bad things happening. There is no question the weight of the evidence supports significant improvement in the odds of good things happening in the coming months and years. A recent Ciovacco Capital weekly client review covered a rare signal in the broad S&P 1500 Composite Index (SPTM). Dating back to 2004, the signal has only occurred four previous times. S&P 500 performance following the historical signals speaks to the potential for additional stock market gains.

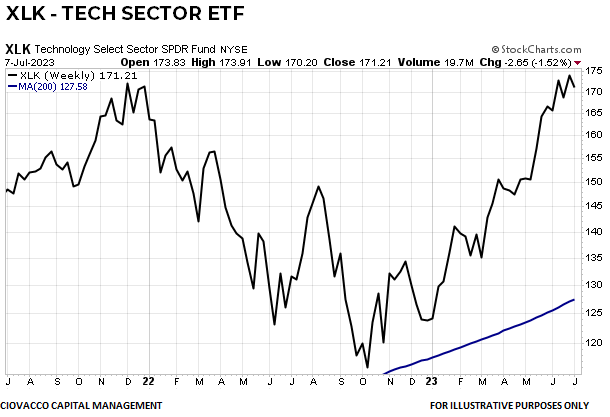

The table below shows the performance of the SPDR Technology Sector ETF (XLK) following the signals in the S&P 1500 Index. Both tables align with the title of the article, which references an improving longer-term outlook for stocks.

THE EVIDENCE HAS BEEN IMPROVING

In a criminal case, jurors want to see the weight of the evidence evolve over the course of the trial. A weight of the evidence approach works in a similar manner when assessing the evolving risk-reward profile of the S&P 500. As shown below via the topics covered since mid-May, the weight of the evidence has clearly evolved along a bullish path:

Debt Ceiling - Market Does Not Look That Bad.

S&P Profile - Looks More Like Bullish Periods vs. Bearish Periods.

Sector Strength - Better Than Most Believe.

Stocks vs. Bonds - Bullish Look.

Multiple Timeframes - Converging In Bullish Manner.

Volume - Institutions Are In No Rush To Sell.

Recession - Charts Not Screaming Economic Contraction.

VOLATILITY IS NORMAL

The charts above speak to odds looking out 36 months, rather than 36 minutes or 36 days. If stocks are higher in three years, investors who wish to take advantage of the long-term uptrend will have to endure normal volatility, givebacks, and corrections along the way.

SECULAR TREND - DETAILED UPDATE JUNE 2023

The video below provides visuals related to the status of the secular bull market in stocks:

BONDS MAY DISAPPOINT IN BALANCED PORTFOLIOS

The video below covers a major event that will impact asset allocation and portfolio returns for decades: